When it comes to safeguarding your financial future, most people think of life insurance as a critical component. However, a less commonly known but important insurance policy to consider is Accidental Death Insurance, often referred to as Accidental Death and Dismemberment (AD&D) insurance. This type of insurance provides financial protection in the event that the policyholder dies or suffers severe injuries due to an accident. While it might not be as comprehensive as traditional life insurance, Accidental Death Insurance can be an essential safety net in certain situations.

In this comprehensive guide, we’ll dive deep into what Accidental Death Insurance is, how it works, what it covers, and whether you really need it. By the end, you’ll have a clearer understanding of whether this form of insurance is worth including in your overall financial plan.

Table of Contents

- What is Accidental Death Insurance?

- How Does Accidental Death Insurance Work?

- What Does Accidental Death Insurance Cover?

- What Accidental Death Insurance Doesn’t Cover

- How Does Accidental Death Insurance Differ From Life Insurance?

- Who Should Consider Accidental Death Insurance?

- Advantages of Accidental Death Insurance

- Disadvantages of Accidental Death Insurance

- How to Choose an Accidental Death Insurance Policy

- Do You Really Need Accidental Death Insurance?

- Conclusion

1. What is Accidental Death Insurance?

Accidental Death Insurance, also known as Accidental Death and Dismemberment (AD&D) insurance, is a policy designed to provide a payout in the event of accidental death or injury. The coverage is limited specifically to accidents, meaning that natural causes of death, such as illness, are not covered.

The benefit from an Accidental Death Insurance policy is typically a lump sum that is paid to the beneficiary. In the case of dismemberment, which refers to the loss of limbs, sight, or certain other bodily functions, a percentage of the total policy amount may be paid to the insured person directly, depending on the severity of the injury.

2. How Does Accidental Death Insurance Work?

Accidental Death Insurance policies are generally straightforward. If the insured dies or is injured in an accident, the insurance company will pay out a predetermined amount to the beneficiaries. The policyholder pays regular premiums to maintain coverage, and the premiums are often lower than those of traditional life insurance policies due to the more limited nature of the coverage.

For example, if someone has a $500,000 Accidental Death Insurance policy and dies in a car accident, the insurance company would pay out the full $500,000 to the policy’s beneficiaries. However, if the insured person loses a limb or becomes paralyzed due to an accident, a portion of the payout will be made based on the specific injury sustained.

Accidents must meet the policy’s criteria for coverage, which usually include sudden, unforeseen events that result in injury or death. Additionally, there may be clauses that specify how quickly after the accident death or injury must occur for the policy to be triggered.

3. What Does Accidental Death Insurance Cover?

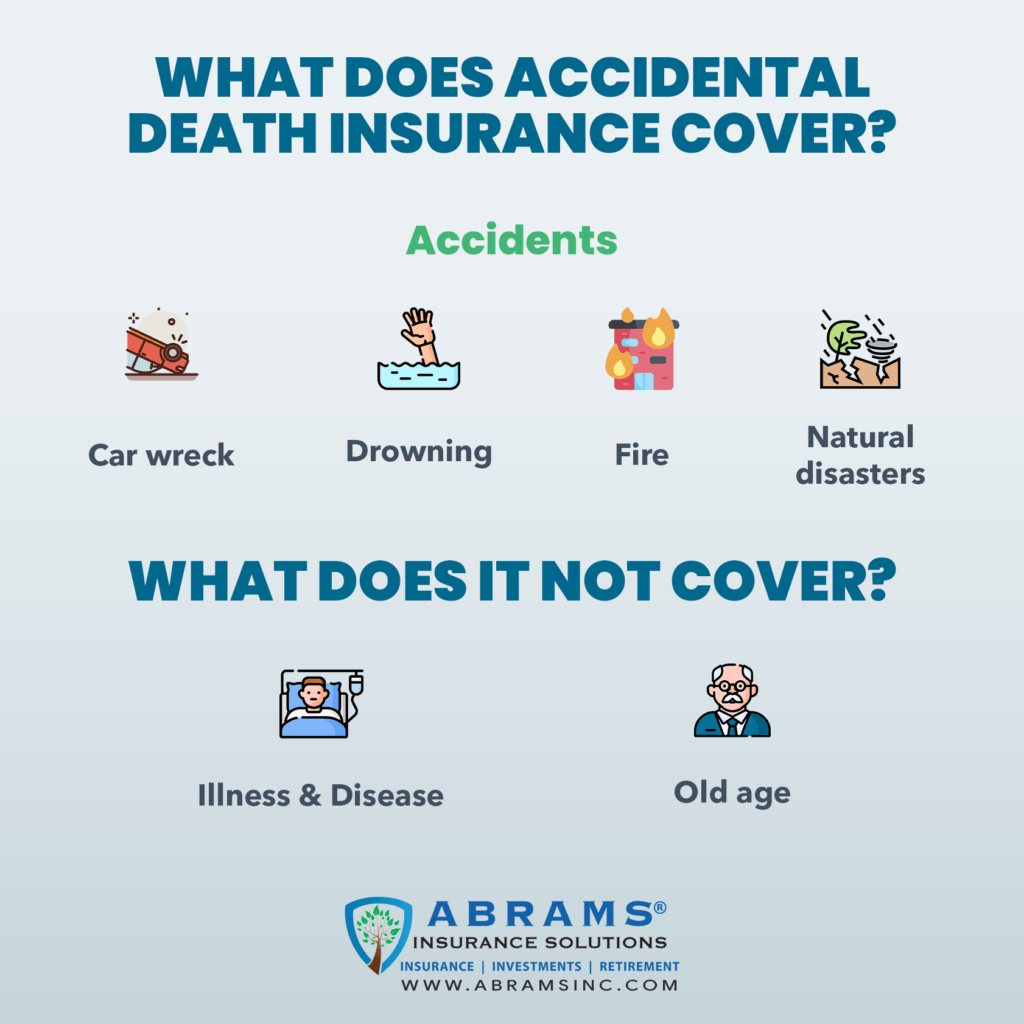

Accidental Death Insurance is designed to provide financial compensation for specific types of accidents that result in either death or serious injury. Here are some common incidents that are generally covered under an AD&D policy:

- Car accidents: If the policyholder dies or is injured in a traffic-related accident, the insurance will pay out according to the policy’s terms.

- Drowning: In cases where accidental drowning results in death, the policy will often pay out.

- Slips and falls: Accidental injuries or death due to slipping or falling can trigger the insurance payout.

- Heavy machinery accidents: People working in high-risk industries, such as construction, may benefit from AD&D insurance due to the possibility of injury or death from heavy machinery.

- Exposure to extreme elements: Deaths or injuries caused by accidental exposure to extreme cold or heat may also be covered.

- Fires or explosions: Accidents involving fire or explosions that result in death or dismemberment may be eligible for benefits under the policy.

These are just examples, and each insurance policy will have its own list of covered accidents. It’s essential to read the fine print carefully to understand what your specific policy covers.

4. What Accidental Death Insurance Doesn’t Cover

While Accidental Death Insurance offers coverage for many unexpected events, it has significant limitations. Here’s a list of common exclusions:

- Natural causes of death: Accidental Death Insurance does not cover deaths resulting from illness, disease, or other natural causes, such as heart attacks or cancer.

- Self-inflicted injuries: Suicides or injuries intentionally caused by the policyholder are not covered.

- Drug or alcohol-related incidents: If the insured dies or is injured while under the influence of drugs or alcohol, the policy often will not pay out.

- High-risk activities: Dangerous activities like skydiving, bungee jumping, or other extreme sports may be excluded, depending on the policy.

- War or terrorism-related incidents: Death or injury as a result of acts of war or terrorism is typically not covered.

- Death or injury while committing a crime: If the insured dies or is injured while engaging in illegal activities, the policy generally won’t provide benefits.

Because of these exclusions, it’s important to understand the specific details of what your Accidental Death Insurance covers and does not cover before purchasing a policy.

5. How Does Accidental Death Insurance Differ From Life Insurance?

While both life insurance and Accidental Death Insurance provide a payout in the event of death, the two policies are quite different. Here are the main distinctions:

- Coverage: Life insurance covers death due to any cause (natural or accidental), while Accidental Death Insurance only covers accidental deaths.

- Premiums: Accidental Death Insurance tends to have lower premiums than traditional life insurance, primarily because its coverage is more limited.

- Payout triggers: Life insurance pays out when the policyholder dies, regardless of the cause. Accidental Death Insurance only pays out in the event of an accidental death or qualifying injury.

- Payout amounts: Accidental Death Insurance often provides smaller payouts compared to life insurance policies, though some plans offer large lump-sum payments for specific types of accidents.

Due to its limited scope, Accidental Death Insurance is typically used as a supplement to life insurance rather than a replacement for it.

6. Who Should Consider Accidental Death Insurance?

Accidental Death Insurance may not be necessary for everyone, but it can be particularly valuable in certain situations:

- High-risk workers: Those working in hazardous environments, such as construction or manufacturing, may benefit from this coverage due to their increased risk of accidental death or injury.

- Young families: Younger individuals with families may consider this policy as an affordable way to provide some financial security in case of an unexpected accident.

- Individuals without life insurance: While Accidental Death Insurance is not a substitute for life insurance, it can serve as a low-cost option for individuals who don’t yet have a comprehensive life insurance policy.

- Frequent travelers: Those who frequently travel for work or leisure may face an elevated risk of accidents and could benefit from Accidental Death Insurance.

- Adventure enthusiasts: If you participate in high-risk sports or activities, having an AD&D policy can provide some coverage, but make sure to check for specific exclusions related to your activities.

7. Advantages of Accidental Death Insurance

- Affordable premiums: Accidental Death Insurance is typically more affordable than standard life insurance, making it an attractive option for those on a budget.

- Straightforward claims process: Because the policy only covers specific types of accidents, the claims process tends to be more straightforward.

- Supplemental coverage: It can serve as a supplement to existing life insurance, providing additional coverage in case of accidental death or injury.

- Dismemberment coverage: In the event of a severe injury like the loss of a limb or paralysis, some policies provide partial payouts to help cover medical expenses and other costs.

8. Disadvantages of Accidental Death Insurance

- Limited coverage: The biggest drawback is that it only covers accidental death and injuries, leaving out other causes such as illness.

- Not a substitute for life insurance: If you rely solely on Accidental Death Insurance, you could leave your loved ones financially vulnerable if you die from natural causes.

- Exclusions: Many policies have exclusions for high-risk activities, substance abuse, and criminal acts, which may limit the policy’s usefulness depending on your lifestyle.

9. How to Choose an Accidental Death Insurance Policy

When selecting an Accidental Death Insurance policy, consider the following factors:

- Coverage amount: Determine how much coverage you need based on your financial situation and the needs of your dependents.

- Exclusions: Review the policy’s exclusions carefully to ensure it covers the types of risks you face.

- Premiums: Compare the cost of premiums between different providers to ensure you’re getting a good deal.

- Additional features: Some policies offer added benefits, such as coverage for dismemberment, hospitalization costs, or even funeral expenses. Evaluate these features to see if they add value.

10. Do You Really Need Accidental Death Insurance?

The decision to purchase Accidental Death Insurance depends on your personal circumstances. If you have traditional life insurance with sufficient coverage, you might not need this extra policy. However, if you work in a high-risk occupation, travel frequently, or engage in adventurous activities, this type of coverage could offer additional peace of mind.

For those without life insurance or for individuals looking for a low-cost supplement, Accidental Death Insurance can provide a financial cushion in the event of an unforeseen accident. However, it’s important to understand that it does not cover natural causes of death, so it should not be your sole form of life insurance protection.

11. Conclusion

Accidental Death Insurance is a targeted policy that provides financial support in the event of accidental death or serious injury. It’s affordable, easy to understand, and can serve as a valuable supplement to life insurance. However, its limitations mean that it’s not for everyone. If you work in a high-risk job, frequently engage in travel, or participate in potentially dangerous hobbies, it may be worth considering. For others, traditional life insurance may offer more comprehensive protection.

Before deciding, assess your financial situation, lifestyle, and current insurance coverage to determine whether Accidental Death Insurance is a good fit for you. As with any financial decision, it’s important to weigh the benefits and drawbacks and ensure the policy aligns with your long-term financial goals.